Welcome to Peoria Area Veterinary Group

We are your local veterinarians in Chillicothe, Dunlap, and Peoria. It is our mission to provide service excellence and superior patient care in order to maintain the highest quality of life for your pets!

Peoria Area Veterinary Group

Cancer Clinic

Peoria Area Veterinary Group provides superior treatment options and shows compassion to pets diagnosed with life-threatening illnesses.

Peoria Area Veterinary Group

Precious Pets Grooming

Our experienced pet groomers can give your pet a fresh look, whether it’s a simple bath and trim or a complete makeover. Our team of skilled groomers can provide various services, including bathing, haircuts, nail trims, and ear cleaning. Contact us today to book an appointment for your furry friend.

Our History

About Peoria Area Veterinary Group

Peoria Area Veterinary Group and its veterinary staff are dedicated to providing our clients with service excellence and superior patient care in order to maintain the highest quality of life for our patients. Thank you for trusting us with their healthcare needs. We are your local veterinarians in Chillicothe, Dunlap and Peoria.

Complete Veterinary Care in Peoria, Dunlap & Chillicothe, IL

Peoria Area Veterinary Group is fully staffed and equipped to offer your pet veterinary care.

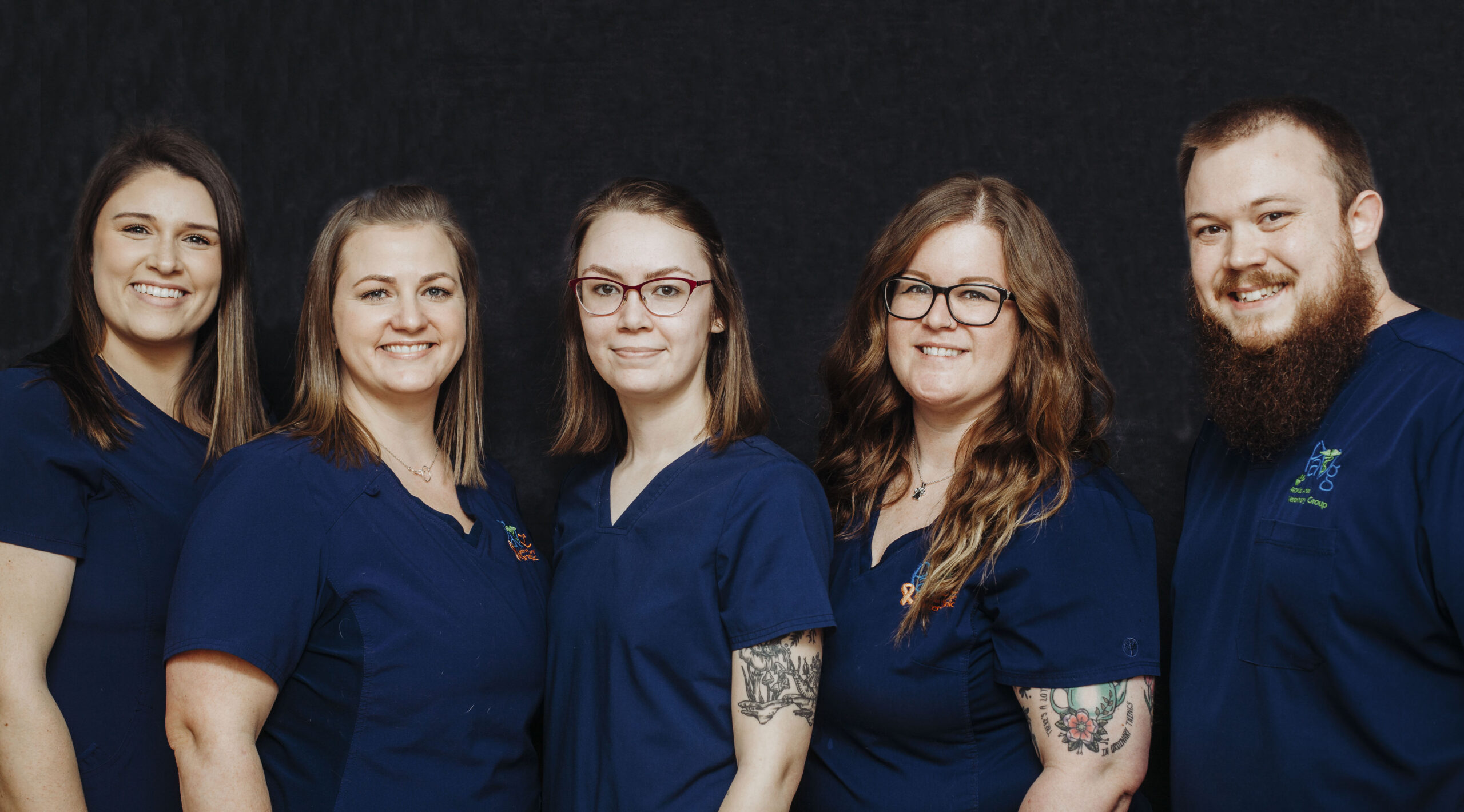

Our Team

Meet Our Veterinary Team

At Peoria Area Veterinary Group, we pride ourselves on treating each patient as if it were one of our own. Our doctors and veterinary staff work hard to provide the pets we see with top-tier veterinary care. Our team is dedicated to delivering the highest quality medical treatment and compassionate care for all our patients. We strive to not only meet but exceed your expectations for veterinary care for your beloved pets.

Our Reviews

Thank you for your kind words

Your kind words mean the world to us, and we’re so thankful that you’ve taken the time to provide us with feedback.